Wells Fargo Sales Pressure Report

High-pressure sales goals are returning for Wells Fargo workers, in an environment already rampant with understaffing and union busting tactics from management. Wells Fargo is more reliant now on incentive pay than at any point since the fake accounts scandal broke in 2013.

Click here to Take Action to support communities and workers getting fair access to in person banking services.

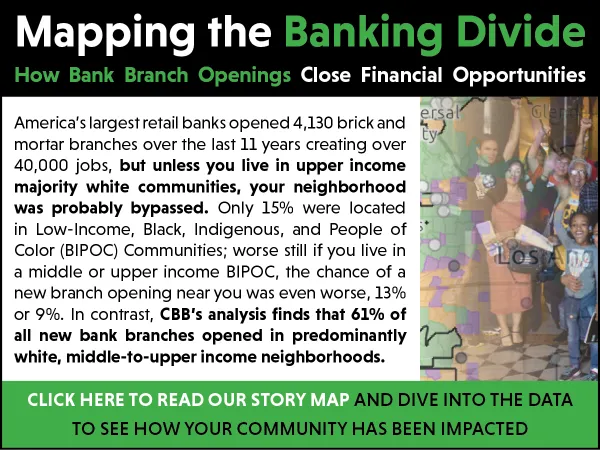

“My job is to help customers and set them up for financial success. It requires face-to-face conversations and human connection that can only happen in a physical banking environment,” said Tasia Barnes, a Wells Fargo Personal Banker at a branch in Fort Myers, FL. “Branches everywhere are woefully understaffed, so being a banker or teller today is very stressful. By not opening bank branches in certain communities, banks are making it more difficult for these customers to access critical services. Banks like Wells Fargo need to put customers first and stop perpetuating cycles of inequality.”

“Banks have an obligation to meet the financial needs of the communities they serve, including the low income communities of color that the banking industry so often leaves behind,” said Paulina Gonzalez-Brito, executive director of the California Reinvestment Coalition. “The findings of this report underscore that there is much work to be done for banks to live up to their promises to promote racial and socioeconomic equity. To start, banks must ensure access to financial services by opening branches in communities across the country, regardless of racial makeup or income level.”