News

Banking Dive: Fed, OCC should probe Wells Fargo’s response to union efforts

News

Banking Dive: Fed, OCC should probe Wells Fargo’s response to union efforts

Banking Dive: Fed, OCC should probe Wells Fargo’s response to union efforts

Budd Got Loans And Cash And Boosted Bank Merger — Before Mass Layoffs

News

Budd Got Loans And Cash And Boosted Bank Merger — Before Mass Layoffs

Budd Got Loans And Cash And Boosted Bank Merger — Before Mass Layoffs

Bank branch openings in U.S. leave behind minority neighborhoods - study

News

Bank branch openings in U.S. leave behind minority neighborhoods - study

Bank branch openings in U.S. leave behind minority neighborhoods - study

Recent

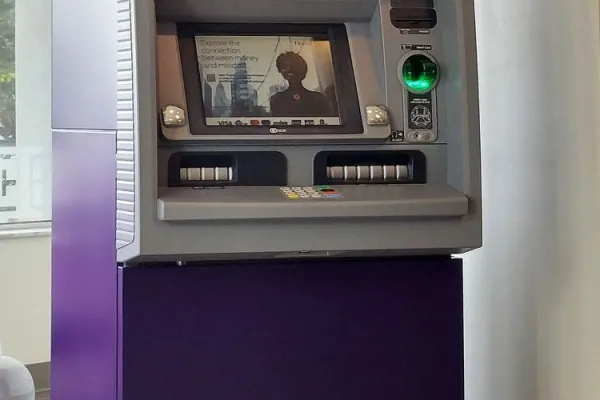

Report: Large banks opened far fewer branches in minority areas since 2010

Wells Fargo employees pushing to organize union across bank’s workforce

San Diego Man Says He Experienced ‘Banking While Black’ In Local Bank of America Branch

From Berkshire Hathaway to Silicon Valley, little to show for diversity pledges, critics say

The Push to Diversify Banking from Within the Industry

'Racial bias runs deep' at America's largest banks, study says